Unlocking £90 Million in Receivables Financing

How a global Media Group financed their global receivables portfolio with competitive terms, no impact on existing covenants, and a 3-year term.

90%

Advance rate

3-Year

Term with 1-year extension

0

Impact on existing covenants

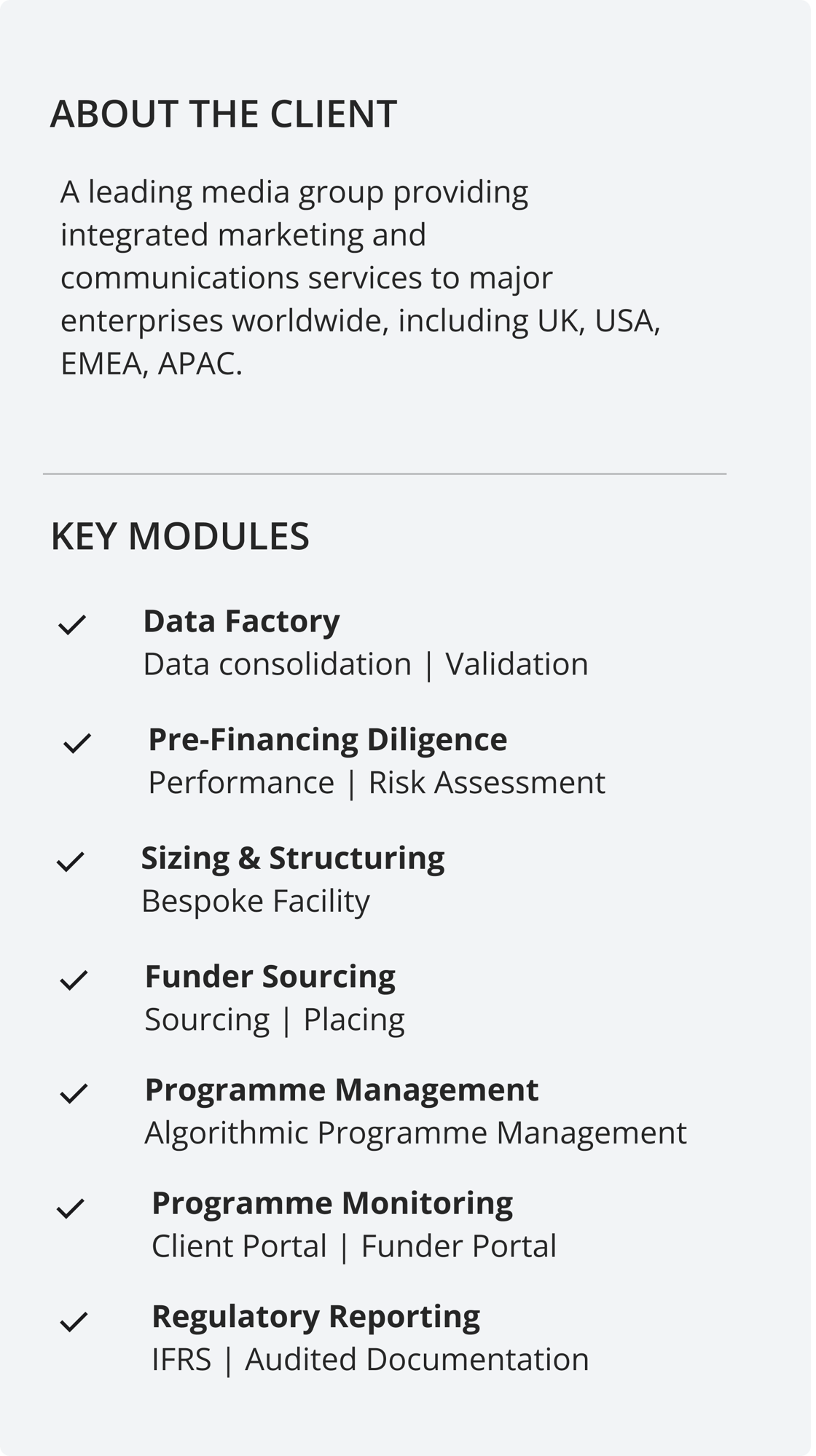

Challenge

The Group sought £90 million to fund operations and ambitious growth. They needed a solution to work with their existing debt covenants, minimise disruptions to their operations, and use their complex global receivables data. Traditional financing routes couldn’t provide the speed, flexibility or desired terms.

Solution

The Group worked with Gardenia Technologies to design and run a bespoke Early Pay Receivables Finance Programme, which delivered a global receivables financing programme at highly competitive rates with zero impact on its existing debt covenants.

Results

Financial outcomes:

£90 Million non-recourse, receivables financing facility

90% Advance rate, with 2.25% interest

Committed facility with 3-year term and a 1-year extension option

Zero impact on existing debt covenants

Global portfolio coverage (UK, USA, EMEA, Australia, Japan, Hong Kong).

Operational outcomes:

Unchanged payment processes and no new bank accounts

Undisclosed facility maintaining client relationships

Algorithmic daily invoice verification and analysis, and next-day cash disbursements

Real-time monitoring and reporting

Ready to optimise your financing?

Learn how Gardenia can help you access best-fit financing programmes from the world’s leading financial institutions.